We have called a boycott of Amazon over its outrageous tax avoidance.

The time is right to focus on a company whose whole business model appears to be based on not paying its fair share of tax.

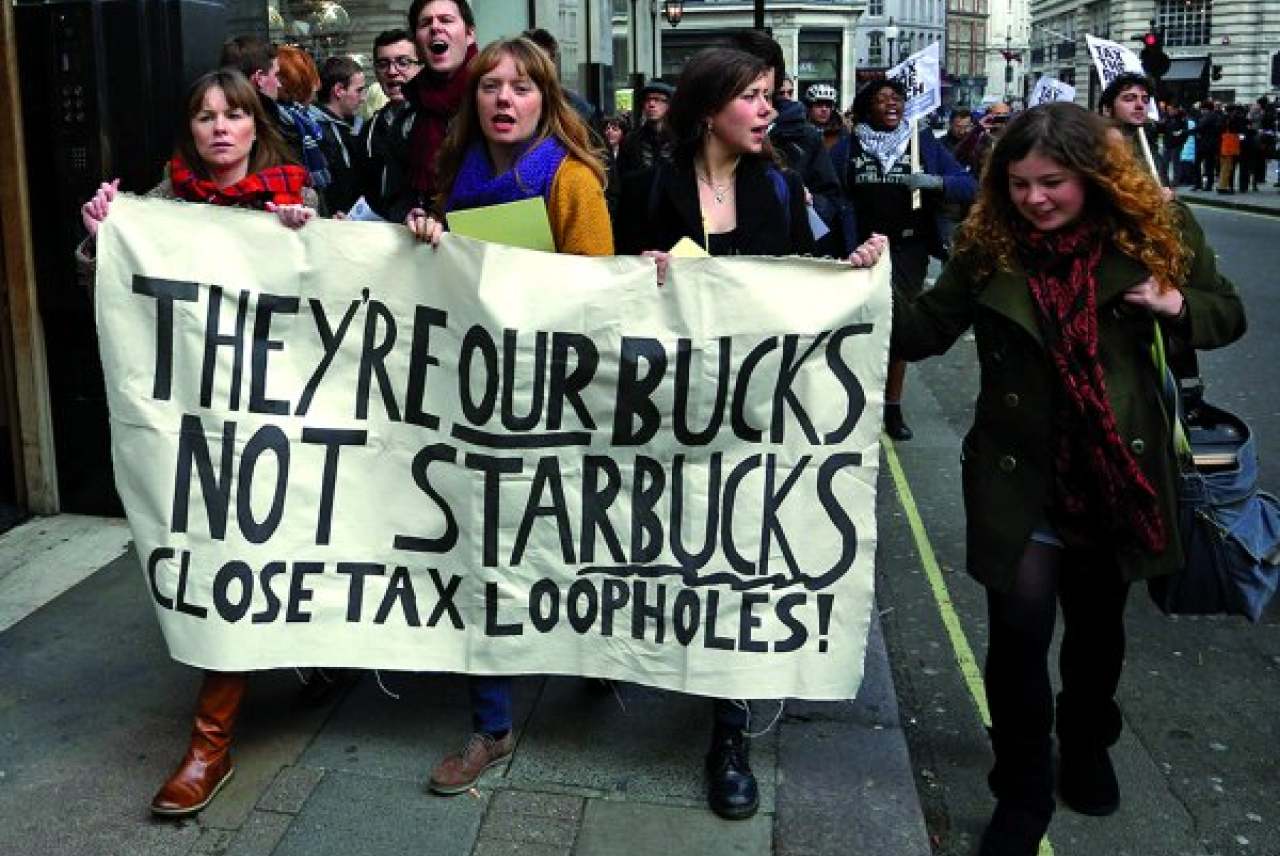

Corporate tax abuse continues to make headline news with more and more companies outed as tax avoiders.

This section aims to help consumers find out more and campaign on the issue.

We preview what fair tax is, how you can find out if companies are fair tax registered, and how we rate companies on their tax conduct. We also link to a global list of tax havens.

We have called a boycott of Amazon over its outrageous tax avoidance.

The time is right to focus on a company whose whole business model appears to be based on not paying its fair share of tax.

Most businesses in the UK should pay tax on their profits, unless they are exempt for some reason, for example charities which have slightly different rules.

However, some companies seek ways to avoid paying as much tax as they should on their profits, often through complicated business arrangements.

To highlight this problem, and help consumers know who is paying their fair share of tax, Ethical Consumer helped to establish the Fair Tax Foundation, a ground-breaking accreditation scheme rewarding businesses that pay a fair amount of tax.

As well as helping consumers to buy from companies that pay a fairer rate of tax, the campaign, also puts pressure on tax avoiders to instigate more socially aware tax policies and more transparent tax reporting.

Fair tax is at the heart of a fair society. We set up the Fair Tax Foundation, alongside our partners, to award businesses with an open and responsible tax policy. Find out which companies have signed up.

Tax avoidance is legal. So what is it and what's the problem with it?

Tax avoidance is shifting profits so you have to pay a lower rate of taxes. It involves using loop holes in tax systems so that you can reduce rates in a way that law makers never intended but which is entirely legal.

All our ratings now contain a tax conduct column, to help show how likely a company is to be engaged in tax avoidance.

While we have long rated all companies on this, our rating was previously buried in the overall anti-social finance column, alongside excessive directors pay and general financial corruption.

We compiled a list of 43 tax havens and explain how we rate companies on tax.

All the information and inspiration you need to join thousands of others and revolutionise the way you shop, save and live. Full online access to our unique shopping guides, ethical rankings and company profiles. The essential ethical print magazine.

We provide an introduction to tax avoidance by retailers including Amazon, explain why it matters, and what consumers can do about it.

A list of just some of the companies in our shopping guides who all score our worst rating for the likely use of tax avoidance strategies.

Includes Twitter links so you can contact the companies directly to ask when they are going to pay their fair share of tax.

Includes big name brands like Amazon, Barclays, Boots, Ikea, McDonalds, Nestle, Nike, and Starbucks.

The financial industry is notorious for tax avoidance – including some well-known high street brands. The majority of the financial institutions we’ve reviewed are high risk for tax avoidance strategies.

We found that many banks own multiple companies in tax havens.

Find out which banks are not paying their fair share of tax, and which ones are (hint, it's often building societies and the more ethical smaller banks which pay their fair share!).