Ethical Consumer

Join thousands of others and become an ethical consumer today.

Join thousands of others and become an ethical consumer today.

Learn how to use your spending power to help change the world for the better.

We are an independent, not-for-profit, multi-stakeholder co-operative with open membership.

At the heart of the ethical consumer movement, since 1989.

We are an independent, not-for-profit, multi-stakeholder co-operative with open membership, based in Manchester.

We provide all the tools and resources you need to make choices at the checkout simple, informed and effective.

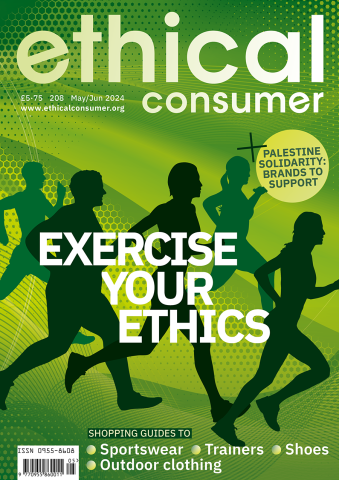

Includes guides to: Outdoor clothing, Shoes, Trainers, Sportswear

The latest magazine includes shopping guides rating:

- Outdoor Clothing

- Shoes

- Trainers

- Sportswear

Plus:

- score tables rating and comparing the brands

- Best Buy recommendations

- get to know Ethical Consumer - a few facts and stats

- what outdoor brands are still using toxic 'forever chemicals'?

- How do vegan synthetics compare to leather for footwear

- workers' rights in the footwear industry

- should you buy polyester sportswear?

Feature on:

- Brands to buy from if you are boycotting Israeli apartheid

Issue 208 (May/June 2024) now in print and online.

- Jane Turner looks at the indelible footprint left by 'forever chemicals' (PFAS) used to make clothing waterproof and investigates what companies and the government are doing about it, and what consumers can do.Read more

- Boycotting brands that are complicit in Palestinian human rights violations is a powerful form of consumer activism, but how ethical is the product you buy instead?Read more

More from Ethical Consumer

How to find sustainable and ethical underwear which is eco friendly. In this guide we investigate, score and rank the ethical and environmental record of 41 brands of underwear which make adult bras and knickers or pants. We look at fabrics, organic and fair trade options, workers' rights, longevity of underwear, secondhand options, price and sizes, and give our recommended buys.

Read more about Sustainable Underwear BrandsWhich are the real sustainable ethical clothing brands? Ratings for 29 UK ethical clothes brands, with Best Buy recommendations. See how brands rate on key areas including use of sustainable fabrics, climate impact, fair wages and working conditions, animal rights, and supply chain transparency. We look at their range of clothing and at the innovators that are going beyond fairtrade and organic. We also cover vintage and secondhand clothing companies, and have a head to head between Depop and Vinted.

Read more about Ethical Clothing BrandsGuide to ethical and sustainable trainers; ratings for 44 brands of trainers, for their ethical and environmental record. We also look at leather including use of kangaroo leather and plant based alternatives, vegan trainers, use of recycled plastic bottles, workers' rights, whether you can wear secondhand trainers, pitch Adidas and Nike in a head to head on ethics, and give our best buy recommendations.

Read more about Ethical TrainersFind ethical, sustainable and fair trade chocolate: ratings for 84 brands of bars of chocolate and chocolate snacks, with recommended brands and ones to avoid. Is all fair trade chocolate equally fair? What are chocolate brands doing about child labour? We look at the big ethical issues including colonialism in the cocoa sector, palm oil and deforestation, child labour, cocoa certification, as well as who makes vegan chocolate, and how to find ethical and responsibly-sourced chocolate to suit your budget.

Read more about Ethical ChocolateGuide to 34 leading UK bookshops, with best buys. Includes alternatives to Amazon and its various book-selling brands and how to find ethical online and local bookshops. We also look at the best options for ebooks and audio books, sustainability, buying secondhand books, and how to support independent authors, publishers and bookshops.

Read more about Ethical BookshopsFinding an ethical mobile phone. Ethical & environmental rankings of 20 mobile phones, Best Buys and what to avoid! Sustainable or eco-friendly phones, conflict minerals, repairability, 2nd hand options.

Read more about Ethical Mobile PhonesEthical and environmental rankings for 43 brands of eggs and vegan egg alternatives. Is it ethical to eat eggs? We investigate egg labelling, vegan egg substitutes, the carbon impact of egg production, and the differences between cage, barn, free range, biodynamic and organic eggs.

Read more about EggsBoycotts can be a useful tool for consumers to exercise their democratic rights. So what is a boycott, are boycotts useful, and when are they ethical?

Read more about What is a boycott?Reliable and easy to use ethical and eco shopping guides, for more than 100 products and services. Helping you to buy ethically, and avoid unethical products and companies.

Read more about Ethical Shopping GuideWe have called a boycott of Amazon over its outrageous tax avoidance since 2012. The list of accusations against Amazon is long, from offering its services to fossil fuel giants to firing activist workers.

Read more about Boycott AmazonShould we boycott palm oil? We share our advice for consumers.

Read more about Palm Oil and Consumers