What is fair tax?

Most businesses in the UK should pay tax on their profits, unless they are exempt for some reason, for example charities which have slightly different rules.

However, some companies seek ways to avoid paying as much tax as they should on their profits, often through complicated business arrangements.

To highlight this problem, and help consumers know who is paying their fair share of tax, Ethical Consumer helped to establish the Fair Tax Foundation, a ground-breaking accreditation scheme rewarding businesses that pay a fair amount of tax.

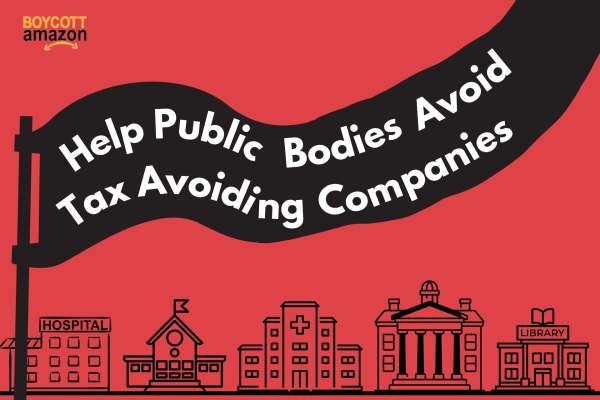

As well as helping consumers to buy from companies that pay a fairer rate of tax, the campaign, also puts pressure on tax avoiders to instigate more socially aware tax policies and more transparent tax reporting.

Our Tax Campaigns