What should governments do about tax avoidance?

Governments decide tax rates, tax credits and accounting laws.

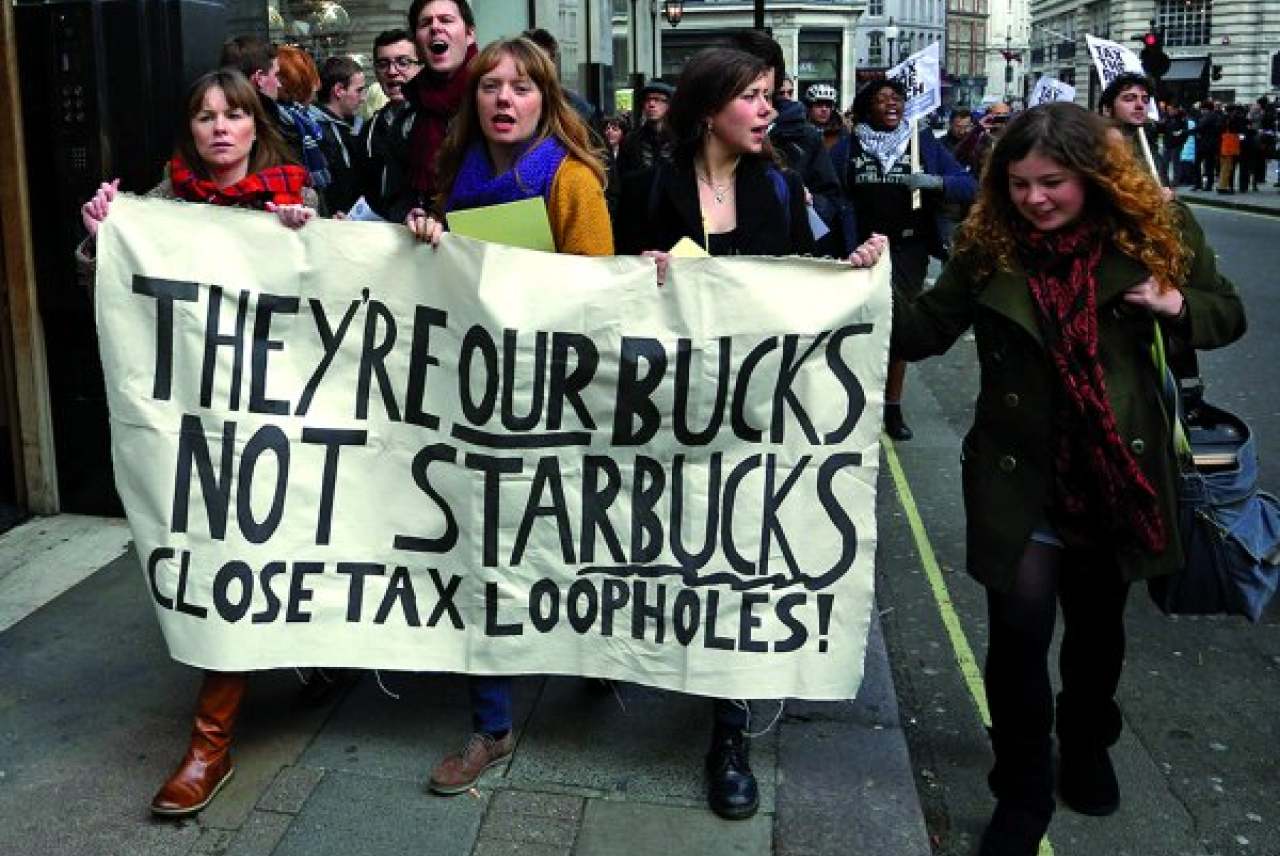

Rich countries should be plugging their own loopholes. Ireland, the Netherlands, Luxembourg and Switzerland all remain on our list of tax havens. The UK would be on there if we weren’t specifically looking for companies that operate in the UK. (If we included the UK all companies – whether using the UK for legitimate or tax haven purposes – would get marked down).

Such countries cost themselves and others important revenue for public services, and desperately need to address the problem.

These countries should also be pursuing international agreements to address the issue as a whole. Without this kind of agreement, change will be incremental and poor countries will continue to have limited chances to respond.

There has been some progress in recent years – from agreeing a minimum global tax rate in 2021 to changing the process by which international tax laws are made in 2023, to shift from a closed door discussion involving predominantly richer nations to a more transparent process under the UN including those from the Global South.

What should companies do about tax avoidance?

Governments can only control tax regulations within their own countries – while companies will continue to exploit laxer tax regulations abroad. This means that tax avoidance is also an issue for corporations and consumers.

By demonstrating a willingness to pay fair taxes, companies can allow countries to charge fair rates as well as contribute to the national infrastructure and resources that they benefit from.

Companies have not only avoided paying taxes, they have pushed for the kind of tax liberalisations that only make the problem worse. In 2017, Amazon asked cities across the US to bid for hosting its second headquarters, and made clear that tax breaks would be a major factor.

As a result, Chicago offered to pay between 50% and 100% of its workers’ income taxes back to the company. Amazon employees would pay tax on their wages, but the revenue would go straight back to the multinational. New Jersey offered $5 billion in tax incentives. And Fresno in California promised to redirect 85% of the company’s taxes into the ‘Amazon Community Fund’ for the next 100 years – a pot that would be jointly managed by Amazon executives.

If governments should not be making these kinds of offers, companies should not be asking them to make such an unsustainable trade-off between generating jobs and funding public services.