Finding an ethical pension provider

This guide rates ethical pension from 23 providers. In theory, all of these are 'ethical' or 'sustainable' in some way. However, the difference in scores between the pension providers at the top and those at the bottom of our ethical ratings table, shows that some ethical pensions are more ethical than others.

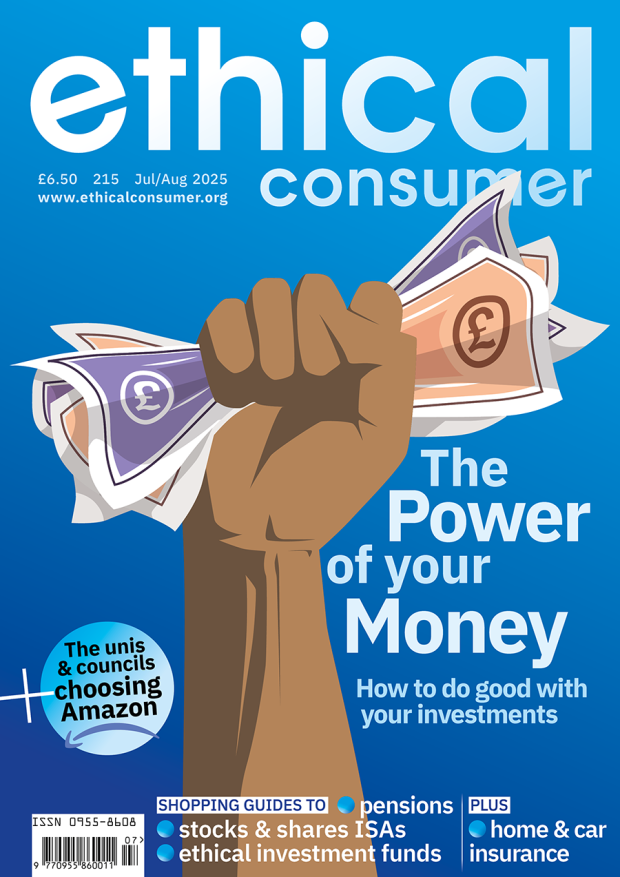

Ethical pensions can have a big impact

It is crucial that we see pensions as more than just a route to later-life financial security. Most people’s pension will be the largest investment they ever hold, so choosing an ethical pension is one of the most ethically productive things you can do.

Global pension funds control an estimated $63 trillion in assets — over four times the value of all sovereign wealth funds combined. That’s a staggering slice of global capital, invested across energy companies, tech giants, banks, real estate, and every corner of the economy. And it is managed in our name.

According to Make My Money Matter, £3,000 per UK pension saver is invested in fossil fuels, and 83%

of providers have inadequate or poor policies on fossil fuels.

But pensions don’t necessarily spring to mind when you think about climate change, injustice, or inequality. They’re slow moving, admin heavy, and are generally absent from our thoughts unless nearing or daydreaming about retirement. But behind that curtain of banality lies a quiet power shaping the world.

Pension funds could feasibly be used to tackle the climate crisis and combat global inequalities.

Yet £300bn of UK pension capital is invested in companies with a high risk of driving deforestation.

And another £88bn is invested in the fossil fuel industry. According to ClimateSafe Pensions, pension funds hold 30% of fossil fuel industry shares worldwide.

If this doesn't sit well with you, read on to find out what your ethical pensions options are.