This is one of our archived guides and as such does not include a score table. However we have kept the page alive so that you can continue to see the key issues in this sector, in both the buying advice and the in-depth analysis.

If there are particular brands you are interested in they may appear in other food and drink guides, or you can search for the company name in the search box at the top of the web page.

Soft drinks guide

In this guide we review carbonated soft drinks, cola and energy drinks. Carbonated beverages are by far the UK’s most popular type of soft drink, representing 37.8% of all soft drink sales.

The soft drinks industry has shown consistent growth in the UK since 2013 and, in the last three years, consumers have been drinking higher volumes per capita. It’s estimated that the average person drinks 79.9 litres of carbonated soft drink each year.

This guide introduces our favourite organic and Fairtrade drinks companies, shares tips on finding vegan-friendly beverages, and discusses the issues around sugar and alternatives.

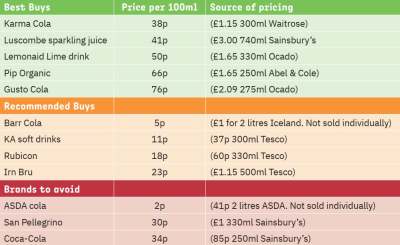

Making your own drinks is by far our top recommendation, but affordable, ethical alternatives to the multinational brand players are also increasingly available as you'll see in our price comparison below. Why wouldn’t you opt for a drink that’s splitting at the seams with ethical certifications?