How did you first get into tax justice?

I first became aware of the enormity of this issue reading Treasure Islands by Nicholas Shaxon in 2012, and, with some old friends, formed the Methodist Tax Justice Network.That developed useful work within the Methodist Church, but then it became clear a wider group was needed and a number of Christian bodies have come together to form Church Action for Tax Justice (CATJ).

Why did you start Tax Justice Sunday?

Tax has to be a serious issue for everyone with an ethical bone in their body. In the Churches, when a new social justice challenge arises, one way to focus people’s minds is to dedicate a Sunday to promote that concern. This has – and still is – being done around, for example, education, the elderly, prisoners, racial justice, refugees and fair trade. One of the founding partners of CATJ has been the Fair Tax Mark and, when they instituted Fair Tax Week in June 2018, they encouraged CATJ to publicise the Sunday in the week as Tax Justice Sunday (TJS).

How have CATJ and Tax Justice Sunday developed?

The first TJS was somewhat minimalist, although it did achieve national publicity. It came about soon after CATJ had been launched in the House of Lords in April 2018, by, among others, the Most Revd Rowan Williams and Dame Margaret Hodge MP, Chair of the All-Party Parliamentary Group on Tax. Fair Tax Mark was there, also Tax Justice UK, and the Tax Justice Network. This demonstrated this is a partnership between those Christians who see this as an essential ‘mission’ issue and the secular groups active in the field. Since then CATJ has been consolidating its position and in March this year published its manifesto, ‘Tax for the Common Good’ (available on the CATJ website along with other resources for Tax Justice Sunday).

Is the tax justice movement spreading among the wider church community?

The Tax Justice movement is also spreading internationally among the Churches. In March I attended a small consultation in Durban, South Africa, organised by the World Council ofChurches and the World Communion of Reformed Churches. It included some 25 representatives from 16 different countries and a range of Christian traditions. It was called to develop the thinking of the Ecumenical Panel on the New International Financial and Economic Architecture, (NIFEA), and to formulate a campaign to initiate at the UN session reviewing the Sustainable Development Goals (SDGs) to be held in New York in July. During the meeting we were constantly reminded of the effects of the dominant global economic system, how destructive it is for the vulnerable and disadvantaged. The representatives from the ‘Global South’ were insistent the process be called ‘Tax Justice and Reparations’ as reordering the financial system should incorporate the idea of repairing the damage done by the colonial past and the environmental destruction appearing in the present, due to the extractive and consumption drivers of Western economic growth.

Are church and other faith groups doing enough to ensure tax transparency in their own ranks?

The Churches of course have large investments, the Church Investors Group (CIG) represents Churches and Charities holding billions in shares. CATJ is urging the CIG to be more proactive in its engagement with large companies who find legal but arguably unethical means of dodging their taxes. CATJ does not distinguish between the legalities of ‘evasion’ and ‘avoidance’. Both are means of getting out of your social and moral obligations. The Churches cannot legitimately call on the wealthy to pay their taxes if it is not willing to put its own funds behind the push for transparency and tax fairness. Church members should be saying this to their investing bodies. Tax dodging is a sin and if taxes are not paid, social and public services will disintegrate and we will all bear the consequences.

Some would say we already are.

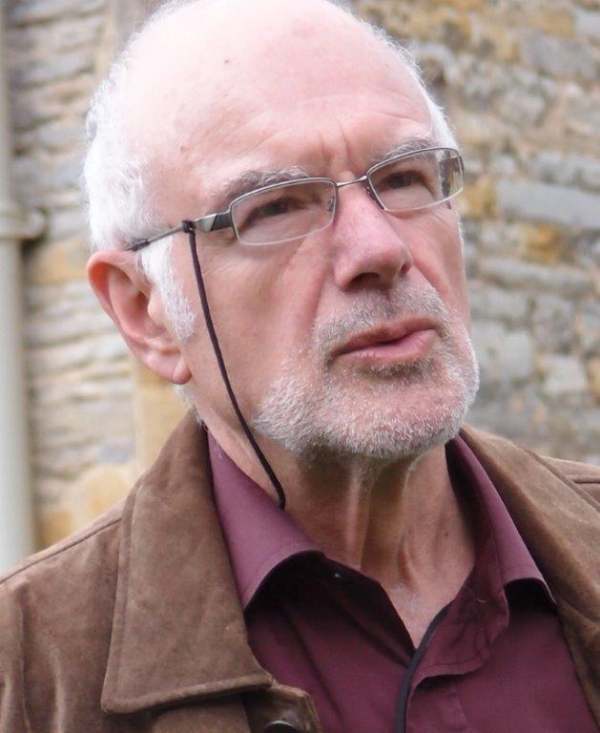

David Haslam is a Methodist minister and a founder and Chair of Church Action for Tax Justice. He is author of ‘The Bible and Tax’, a pamphlet available with other resources including for Tax Justice Sunday (7th July) from CATJ.

CATJ will also be appearing at the Fair Tax Conference, led by Fair Tax Mark, Friday 5th July in London.